Support our Mission of Service to Humanity

This donation page is intended for Indian donors. Non-Resident Indians (NRIs) are also welcome to donate here.

Tax Benefits & Compliance:

80G Tax Exemption: All donations are exempt under Section 80G of the IT Act, 1961 (Applicable to Indian donors).

Mandatory ID Proof: As per Income Tax Rule 18AB, donors must provide an ID Number (PAN or Aadhaar) to receive tax benefits, regardless of whether you intend to claim the exemption.

Foreign Donors: Currently, this portal is for Indian/NRI accounts. For foreign currency donations, please Contact Us directly.

Some of our Major Activities which need your support

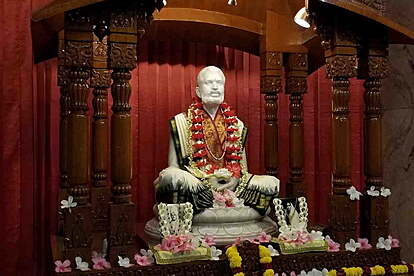

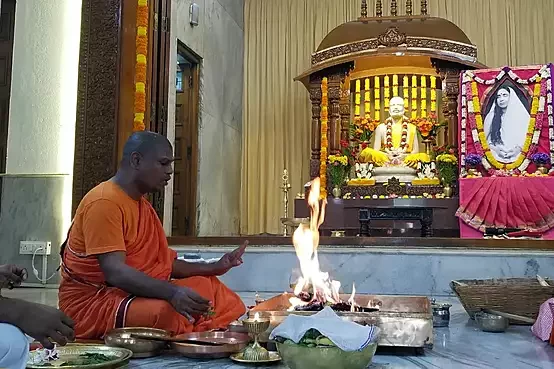

Temple – Puja and Seva

Celebration and Titi Puja

Sadhu Seva

Free Tuition Centre

Free Scholarship